Contents

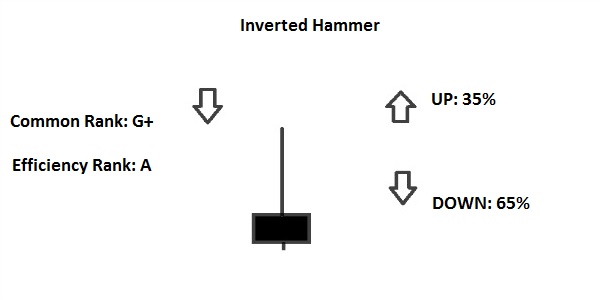

A chartist will occasionally encounter pattern failures despite most of the qualifying criteria being met. If a pattern is not working as was initially anticipated, it is always better hanging man candlestick to exit the trade and limit the losses rather than holding on to a losing position based on hope. After all, risk management is the most important part of technical analysis.

- Wedges are counted among the most popular and widely traded reversal patterns.

- That much distance should be extended on the chart below the breakdown from the bottom trend line.

- Occasionally, the contracting triangle pattern could act as a reversal pattern too, especially if it appears near the end of an ongoing trend.

- Sometimes, when price is trading within the rectangle, volume picks up modestly during rallies and fades during declines.

This information has been prepared by IG, a trading name of IG Markets Limited. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Notice how the upper trendline connects higher highs, and how the lower trendline connects lower lows. As such, this wedge is expanding or broadening as the price action progresses.

Price then declines from the high of the left shoulder, makes a new low, and then heads higher and back towards the high of the left shoulder. Once the decline starts from the high of the head, a chartist can draw an extended neckline connecting the high of the left shoulder and the high of the head. The drop from the high of the head fails to break the previous bottom before heading higher again. The pattern is complete and a reversal is indicated once price breaks above the neckline connecting the high of the left shoulder and the high of the head.

Market: 2023 begins on a cautious note

Retail investors should not try to trade by following this pattern because it is very difficult to identify the final breakout. Finally, after the completion of an Inverse Head and Shoulders pattern indicates a bullish trend reversal. The price falls a third time, but only to the level of the first trough, before rising again and reversing the trend. The price finally rises for the third time, but only to the level of the previous peak before falling again. Note that price patterns can be applied to line chart, bar chart, or candle chart.

In order to form a descending wedge, both the support and resistance lines have to point downwards and the resistance line should be steeper than the line of support. A cup and handle formation is similar to a cup and handle with the cup shaped like a “u” and the handle slanted downward. The pattern consists of a price decline followed by a price rebound to the previous level, followed by a smaller decline, and then a rise past the previous high resistance level. It is interpreted as an indication of market bullishness and potential price increases. The drop of the handle portion should retrace approximately 30% to 50% of the rise at the end of the cup. It is a bullish signal that extends an uptrend and is used to identify opportunities to go long.

There is the inverse cup and handle pattern, which is a bearish continuation pattern. The inverse cup and handle are used to spot bearish trades in the market. Once finished, the market will break out into a bullish ascending trend. When volumes go down when prices are low, and when there is a breakout, the volume should be up.

Falling Wedge Pattern Works

These are easy to read, quick to comprehend, and relatively simpler to integrate with your chart pattern trading strategies. Broadening wedges are a less common variation of the wedge pattern formation. Within broadening wedges the price action expands rather than contracts. And so, on the price chart a broadening wedge formation will appear as two diverging trendlines that contain the price action. Though both symmetrical triangles and pennants can be formed during an uptrend or a downtrend, there is a small difference in their interpretations as well. Being a part of the continuation patterns, it’s almost certain that the price continues in the same direction once the pennant is complete.

Trading is not appropriate for all investors, and the risks can be substantial. You acknowledge that it is solely your decision to determine which, if any, PatternsWizard trading signals and contents to use https://1investing.in/ for trading . Statistics provided are the result of backtests and are provided as is with no guarantee. Leverage can work against you as well as for you, and can lead to large losses as well as gains.

Chart patterns

Similarly, a falling wedge formation after a steep correction should be treated as a turnaround pattern and a rising wedge at this place should be considered a continuation one. A rounding top is a bearish reversal pattern that appears at the end of an uptrend. This pattern marks an end to the prevailing uptrend as it represents a gradual shift from demand to supply. The first part belongs to the buyers as price continues to rally. The second part shows an equilibrium between buyers and sellers, and provides the first hint that buying interest is starting to recede as price moves in a horizontal range.

There are two types of wedges, one is the rising wedge and the other is the falling wedge pattern. A rising wedge pattern is a micro uptrend that occurs in a major downtrend. When the trendline of this wedge breaks, the price can again join the major downtrend. Triangle patterns are a type of chart pattern that traders look for when the trading range of a stock price narrows after an uptrend or downtrend.

It is relatively rare to find three bottoms and two intervening highs at exact levels. Sometimes, the bottom or the intervening peaks might be slightly ascending or descending rather than horizontal. A Pennant pattern is a continuation chart pattern and the last one in the list of most important patterns in trading. The pattern resembles a little symmetrical triangle known as a “pennant,” which is composed of several candlesticks.

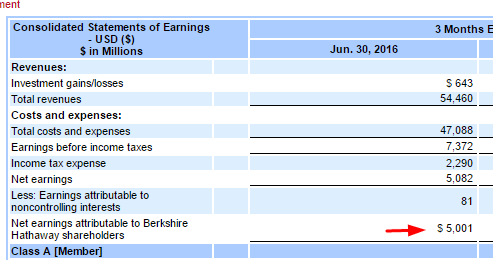

Global Investment

If this happens, and if volume has picked up after the breakdown, then a move lower can be expected. Unlike triangles, however, Pennants are primarily used to forecast short-term price movements. Depending on the direction, wedges can also inform analysts of either a bullish or bearish trend fatigue. Our web-based trading platform allows traders to automatically scan for wedge patterns using our pattern recognition scanner. However, not all wedges highlighted may be ones you would trade.

Ascending Triangles

Sometimes the level of resistance is too high, and there is simply not enough run-up to push it through. The argument here is that one shouldn’t be obsessed with which direction the price goes, but rather that you should be prepared for movement in any direction. Notice above that before entering into the consolidation, price was in a steady downtrend. Also notice the sharp increase in volume accompanying the breakdown. Notice how volume declined sharply during the first half of the pattern, while increasing sharply during the second half and then during the breakout from the neckline. Confirmation from the volume increases the probability of an up move once the neckline is broken.

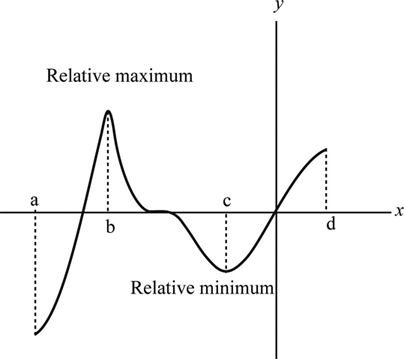

The price falls again, forming a second trough significantly below the initial low, before rising again. The price again rises to form a second high that is significantly higher than the initial peak, and then falls again. However, if the wedge is pointing against the trend, the probability lies on the side of a continuation. • Trend lines are the best way to spot the narrowing of the channel, which is the first key sign that the reversal is on the way ahead. In today’s digital era, one should be aware of all the tools available in the market like stock screeners in order to identify buying and selling opportunities. We at Enrich Money, do not promise any fixed/guaranteed/regular returns/ capital protection schemes.

In this pattern, the price makes two lows at or about the same level before it starts a bullish uptrend. The level from where the price starts to rise again becomes a support or demand zone. This is because the price has taken support at that level despite the sellers trying to take the price lower twice.